When Isabella wrote Interrupted in 1881 she was forty years old and had lived through one of the greatest financial disasters in American history.

It was a troubling time for the country, and Isabella reflected that trouble in her story. The main character, Claire Benedict, is a young woman raised in the lap of luxury, who suddenly finds herself—along with her mother and sister—virtually penniless when her father dies unexpectedly.

It was a troubling time for the country, and Isabella reflected that trouble in her story. The main character, Claire Benedict, is a young woman raised in the lap of luxury, who suddenly finds herself—along with her mother and sister—virtually penniless when her father dies unexpectedly.

Isabella wrote:

How do such things occur? I cannot tell. Yet how many times in your life have you personally known of them—families who are millionaires today, and beggars tomorrow? It was just that sort of blow which came to the Benedicts.

Isabella had seen real-life examples of wealthy businessmen turned into paupers overnight. Just eight years before Interrupted was published, America suffered through The Panic of 1873.

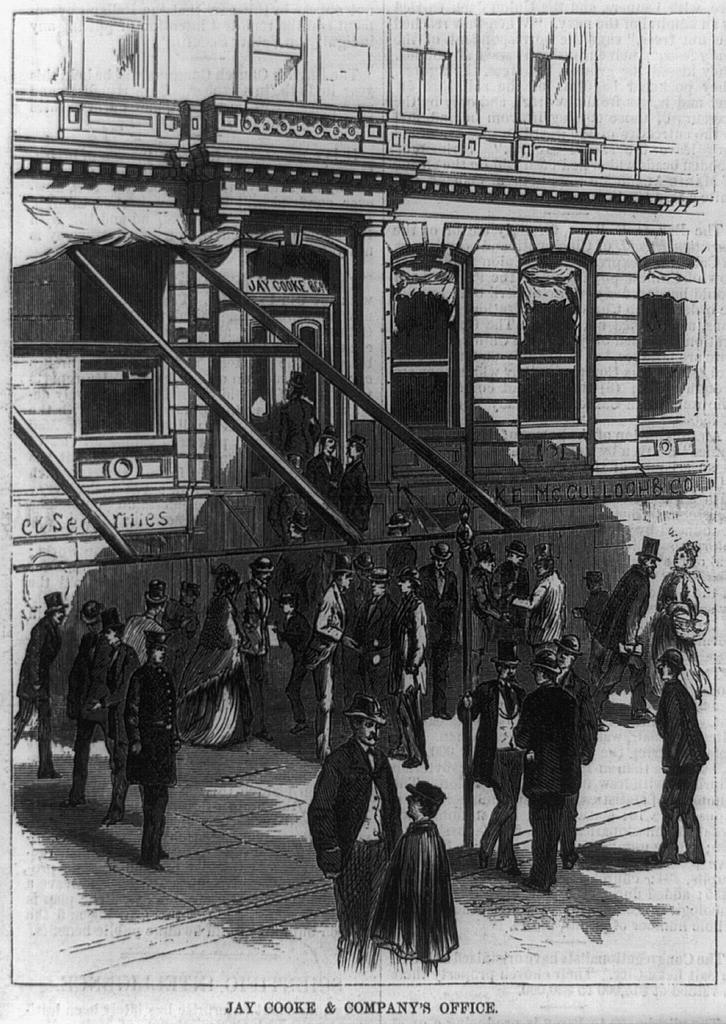

The Panic was caused by many factors, but the fatal spark came from Jay Cooke & Co., an American banking house that borrowed heavily to finance railroad expansion in the U.S.

Cooke was caught using a number of deceptive business practices, including shell companies to hide costs from investors, a scheme discovered in 1872. The revelation damaged investor confidence, and Cooke’s bank suffered heavy losses until, in 1873, Cooke was forced to suspend all deposits and payments, and closed the bank’s doors.

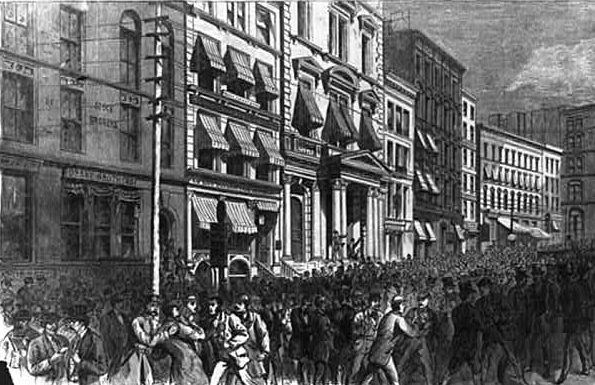

That announcement sent shock-waves through Wall Street, and led to a panic of bank runs and bank failures throughout the country.

The extent of the economic crash was so great, the New York Stock Exchange closed two days later and stayed closed for ten days.

Those banks that survived the initial crash immediately called in their debts, which caused an alarming number of foreclosures and bankruptcies throughout the country.

The Panic of 1873 commenced on September 18; by and the end of the year . . .

- One in every eight Americans was unemployed

- Employers that were still in business cut wages, on average by 25%

- Construction of businesses and homes came to a standstill

- The value of land dropped and profits crashed

- Tens of thousands of workers—many Civil War veterans—became homeless transients, making “tramp” a commonplace American term

Retailers did their best to keep their doors open. Many abandoned attempts to make a profit and had to be content to merely break even.

It was a desperate time in America; and the economic depression that followed the crash lasted almost seven years.

As the economy began a slow recovery, the average Americans found the financial rules had changed.

For starters, there was a lopsided disparity of wealth distribution. Rich industrialists like Andrew Carnegie and John Rockefeller, who survived the Long Depression intact, now owned over 71% of the nation’s wealth.

The average American found banks no longer wanted their business. J. P. Morgan’s banking house required a minimum personal value before they allowed a new customer to even walk in their door.

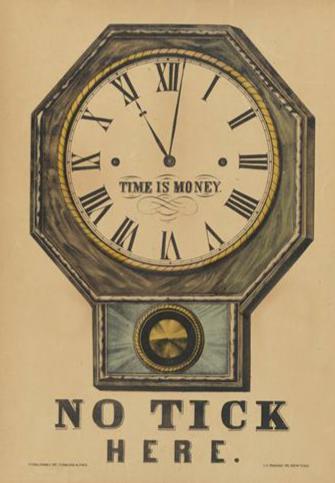

So Americans had no choice but to turn to cash.

It was a natural reaction, since most Americans were aware that buying on credit and shady financing deals had caused the Panic of 1873 in the first place. They came to distrust credit and lending institutions, and developed their own barter systems and cash-only policies.

Isabella wrote about it in The Pocket Measure.

In that story, Mrs. Spafford suggests to a group of girls from church that they earn money by starting a business selling hand-made items.

“Where would we get our material?”

“We would need a buying committee—someone whose duty it would be to purchase material.”

“Suppose she hadn’t money enough for the purchases?”

“Then we should manifestly have to do without the material until such time as we could afford to enlarge our business.”

“Couldn’t we buy on credit?”

Both Mrs. Spafford and Addie Stowell shook their heads emphatically at this, and Addie said:

“No, ma’am! You don’t catch me launching out in any enterprise that hasn’t a solid cash foundation. I should expect my father to disown me forthwith. If there is anything he hates, it is the credit system.”

Almost all of Isabella’s novels reflect that sentiment. From David Ransom’s Watch to Ester Ried’s Namesake, Isabella made certain her characters earned the money they needed. They didn’t buy anything “on credit.”

Her characters saved up for years to purchase a train ticket or a new dress.

They counted pennies and survived on johnny cakes and molasses.

In fact, most of Isabella’s stories feature characters who live in poverty—the sort of poverty Isabella witnessed first-hand in the years following the 1873 crash.

What do you think?

Do you have a favorite Isabella Alden book that features characters who were poor or insisted on earning the money for the things they wanted to buy? Share your favorite Isabella book by commenting in the Leave a Reply box below.

You can learn more about the Financial Panic of 1873 by watching this short video about the Panic’s impact on the citizens of Illinois:

And you can click on any book cover to find out more about Isabella’s novels mentioned in this post.